The holiday season is upon us, and with it comes the joy of gift-giving. However, keeping track of your holiday spending can be overwhelming, especially if you have a large family or a long list of friends to buy for. In this article, we will explore the importance of tracking your Christmas gift and holiday spending, and provide a comprehensive guide on how to do it effectively.

Managing your finances during the holiday season is crucial to avoid overspending and financial stress. According to the National Retail Federation, the average American spends over $1,000 on holiday gifts, decorations, and other items. Without a clear budget and tracking system, it's easy to get caught up in the excitement of the season and spend more than you intended.

Benefits of Tracking Your Holiday Spending

Tracking your holiday spending offers numerous benefits, including:

- Staying within budget: By monitoring your expenses, you can ensure that you stay within your means and avoid financial stress.

- Reducing debt: Keeping track of your spending can help you avoid accumulating debt during the holiday season.

- Increasing savings: By prioritizing your spending and making conscious financial decisions, you can save money for future expenses or long-term goals.

- Improving financial discipline: Tracking your spending can help you develop healthy financial habits and improve your overall financial discipline.

How to Track Your Christmas Gift and Holiday Spending

There are several ways to track your holiday spending, including:

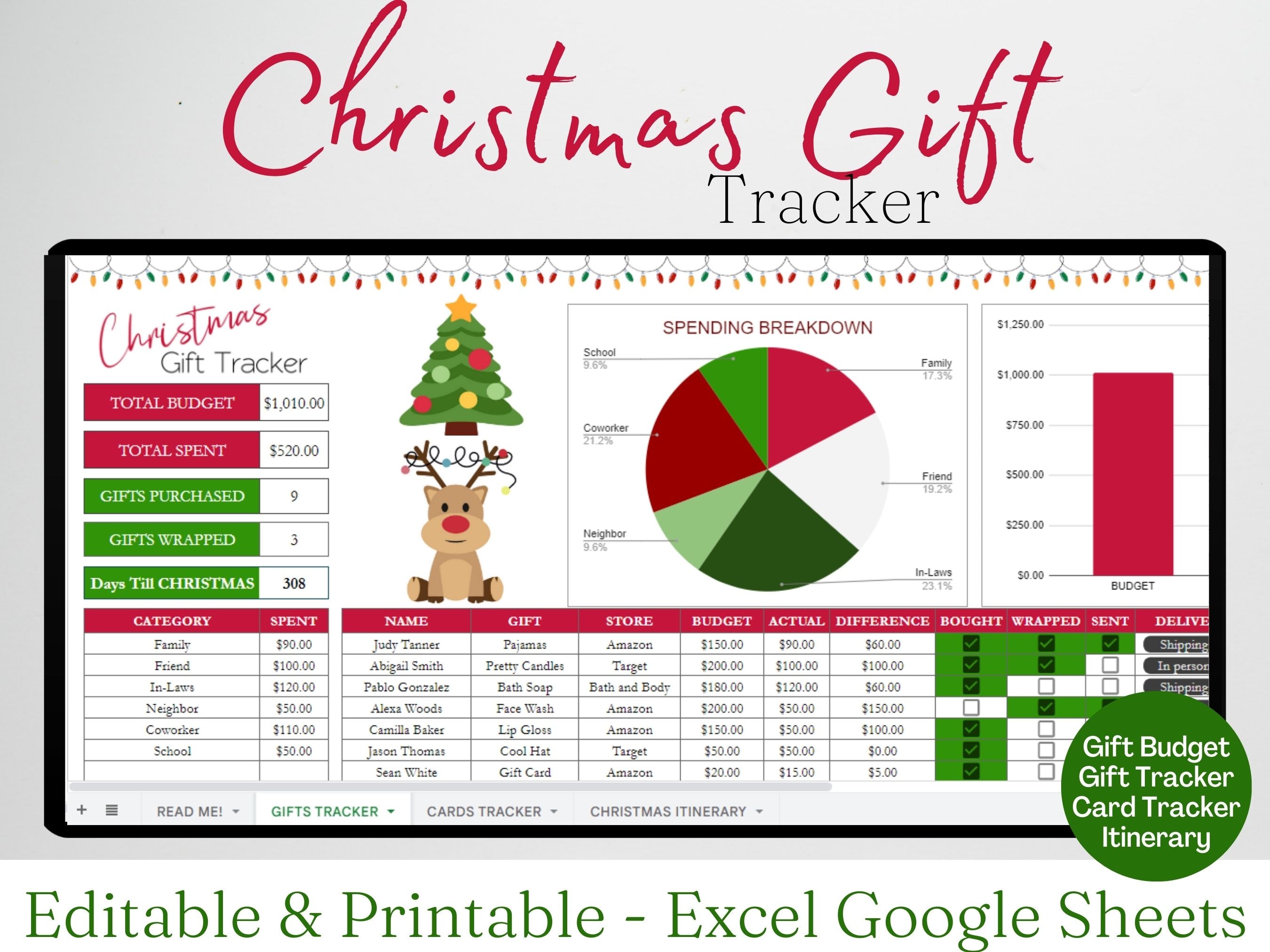

1. Spreadsheets

Creating a spreadsheet is a simple and effective way to track your holiday spending. You can set up columns for different categories, such as gifts, decorations, and travel, and enter your expenses as you go.

2. Budgeting Apps

There are many budgeting apps available that can help you track your holiday spending. Some popular options include Mint, You Need a Budget (YNAB), and Personal Capital.

3. Cash Envelope System

The cash envelope system involves dividing your expenses into categories and placing the corresponding budgeted amount into an envelope for each category. This can help you stick to your budget and avoid overspending.

4. Holiday Budgeting Templates

You can find many holiday budgeting templates online that can help you track your spending. These templates often include categories for gifts, decorations, and other holiday expenses.

Tips for Effective Holiday Spending Tracking

To get the most out of your holiday spending tracker, follow these tips:

1. Set a budget: Before you start tracking your spending, set a budget for the holiday season. This will help you stay focused and ensure that you don't overspend.

2. Categorize your expenses: Divide your expenses into categories, such as gifts, decorations, and travel. This will help you see where your money is going and make adjustments as needed.

3. Track every expense: Make sure to track every single expense, no matter how small. This will help you stay accurate and ensure that you don't forget any expenses.

4. Review and adjust: Regularly review your spending tracker to ensure that you're staying within budget. Make adjustments as needed to stay on track.

Common Holiday Spending Categories

When creating your holiday spending tracker, consider the following common categories:

1. Gifts: This category includes expenses related to purchasing gifts for family and friends.

2. Decorations: This category includes expenses related to decorating your home for the holiday season.

3. Travel: This category includes expenses related to traveling during the holiday season.

4. Food and drink: This category includes expenses related to holiday meals and entertaining.

5. Charitable donations: This category includes expenses related to charitable donations made during the holiday season.

Conclusion

Tracking your Christmas gift and holiday spending is a crucial part of managing your finances during the holiday season. By following the tips and guidelines outlined in this article, you can create a comprehensive spending tracker that will help you stay within budget and avoid financial stress. Remember to categorize your expenses, track every expense, and review and adjust your spending regularly. With a little planning and discipline, you can enjoy the holiday season without breaking the bank.

Why is it important to track my holiday spending?

+Tracking your holiday spending helps you stay within budget, reduce debt, and increase savings. It also helps you develop healthy financial habits and improves your overall financial discipline.

What are some common holiday spending categories?

+Common holiday spending categories include gifts, decorations, travel, food and drink, and charitable donations.

How can I create a holiday spending tracker?

+You can create a holiday spending tracker using a spreadsheet, budgeting app, cash envelope system, or holiday budgeting template. Choose the method that works best for you and stick to it.